Renewable Chemical Production Tax Credit

Business Programs

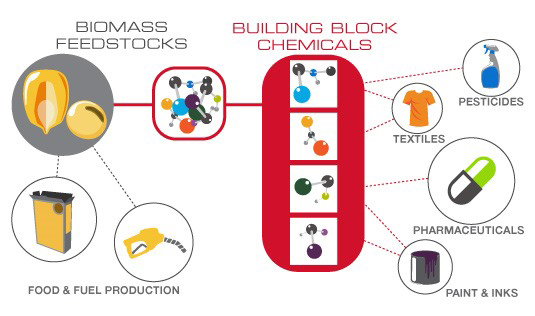

Turning Biomass Into Business

Iowa offers the Renewable Chemical Production Tax Credit. The program incentivizes the production of 30 high-value chemicals derived from biomass feedstocks. According to the U.S. Department of Agriculture, the credit represents the “strongest” incentive package for the bio-based chemical industry.

Iowa offers the Renewable Chemical Production Tax Credit. The program incentivizes the production of 30 high-value chemicals derived from biomass feedstocks. According to the U.S. Department of Agriculture, the credit represents the “strongest” incentive package for the bio-based chemical industry.

Iowa developed the program to capitalize on its resources and infrastructure and to capture the renewable chemical manufacturing industry; it addresses the unique opportunity to advance Iowa’s economy by focusing on the development of biomass as feedstocks for the production of renewable chemicals.

- Annual limits of $1 million for startups and $500,000 for established businesses

- Incentivizes production based on weight ($0.05 per pound produced)

Who Qualifies?

- Companies physically located in Iowa

- Operated for profit and under single management

- Not an entity providing professional services, health care services, or medical treatments or a retail operation

- Organized, expanded or located in Iowa on or after April 6, 2016 (includes NEW businesses in Iowa and EXISTING businesses that expanded production after April 6, 2016)

- Will not relocate or reduce operations in Iowa

- In compliance with all agreements entered into under this program or other programs administered by IEDA, if any

How Do I Apply?

- The application period for chemicals produced in 2023 is February 15 - March 15, 2024.

- During the filing window, the application will be available at govconnect.iowa.gov. Select "Create a Logon" prior to seeing the options to apply for a tax credit.